May flew by, and there was a lot of work to be done, but also a couple of free holidays and birthdays. Our little girl turned 5, talk about time flying by! A great month in life, a terrible month in the market. The total portfolio was down 6.77%, following a 4.45% loss the previous month. I have been buying many stocks, but the markets kept diving after I had bought them. I am still happy with the entries, but I see the market handing some more opportunities to buy in the coming weeks.

Capital Growth Portfolio

This month, the portfolio is down 0.04%, and we can see the drop is slowing down.

I started using a different method to calculate if the portfolio is up or down. Previously, I would remove the deposit, which means the portfolio’s performance is -1.68% because I invested €100. Sometimes you will see the total value go up compared to the month before and the growth will still be negative, which is just weird to me.

The only downside here is this will sometimes sugarcoat the actual performance of the assets I already had. I might circle back on this in a few months.

Portfolio value: €6077.44

Deposits: €100

Growth/decline: -€2.38

Retirement Fund Portfolio

The retirement portfolio is up a little at a 2.35% increase.

Portfolio value: €2322.27

Deposits: €100

Growth/decline: €53.24

Index Fund & Stock Portfolio

As I said earlier markets were dropping fast last month, which meant a lot of my buy orders hit. Check the list below:

- 14 Pinterest (PINS) stocks @ $19.63

- 72 Opendoor (OPEN) stocks @ $6.16

- 75 Invitae (NVTA) stocks @ $4.35

- 100 Virgin Galactic stocks @ $6.71

- 60 iShares Nasdaq US Biotechnology (2B70) @ $4.752

- 100 Rize Sustainable Future of Food (RIZF) @ 4.334

Unfortunately, I didn’t buy the bottom but there is still some room to buy some more in the coming weeks.

Portfolio value: €7710.44

Deposits: €200

Cash: -€1772.55

Passive income: €5.60

Real Growth/Decline: -€651.96

Ideal allocation (December 2021):

- Stocks: 75%

- ETFs & Cash: 25%

If you want to start investing as well, the platform I’m investing on is DeGiro, but you can also invest on other platforms like eToro.

Semmie Portfolio

No deposits, just a small loss of 1.41%.

Portfolio value: €268.72

Deposits: €0

Growth/decline: -€3.83

P2P Lending Portfolio

Mintos

Still paused any further deposits. Once I reach €1000 on this platform and €500 on EstateGuru, I will diversify platforms. The last 2 years have been really nice on Mintos.

Portfolio value: €782.11

Deposits: €0

Passive income: €4.88

If you sign up using my affiliate link, we will both receive 1% of our average daily balance, which is paid in 3 instalments for the first 90 days.

EstateGuru

I’m currently invested in 6 projects on EstateGuru with a 9-11% interest rate.

Portfolio value: €374.59

Deposits: €0

Passive income: €2.17

If you sign up using my affiliate link, we will both receive a 0,5% bonus on all the investments done during the first 90 days of your registration on all the investments that move to funded status.

Crypto Portfolio

This part of the portfolio took the biggest hit. After a 17.92% drop last month, we are now dealing with a 24.60% drop. I still can’t complain with only an €82 euro investment left after cashing out a part of my portfolio last year. I’m starting to get interested in rebuying BTC and ETH.

The rest of the assets are still growing slowly because of the interest. Swissborg is giving me a 4.5% yield on my bitcoin and 7.75% on my USDC. The BlockFi interest rates have increased again this month, unfortunately, bitcoin is still 4.5%. Celsius is becoming more interesting to test because of this.

I also want to remind everyone, especially now that crypto is quickly appreciating in value, how important it is to keep the bulk of your crypto off the exchanges you are trading on. I keep mine on a Ledger.

Portfolio value: €3613.88

Bitcoin value: 0.0517814

Ethereum value: 0.70134589

Deposits: €0

Withdrawals: €0

Growth/decline: -€1179.32

Total Portfolio Overview

Portfolio value: €21274.27

Deposits: €400

Withdrawals: €0

Passive income*: €12.65

Total growth/decline: -€1545.39

Real growth/decline: -€1945.39

* This only includes P2P & Dividend

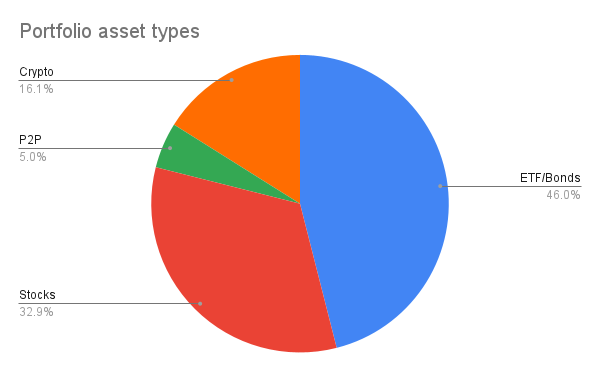

Ideal allocation (January 2022):

- ETF & Bonds: 45%

- Stocks: 25%

- Cash: 0-5%

- P2P-lending: 5%

- Crypto: 20%

Ideas for June

In the coming months, it is time to add some to the cash position and invest a little more in crypto if the crypto portfolio doesn’t turn around. This will be needed to keep the 20% allocation.

Website Goals

- Nothing new planned