The last week of February I was on a skiing trip with the family. Normally, this is my depositing week, but I totally forgot about this during the trip, so this month I didn’t really invest anything manually. This means my deposits are between €200-400 lower than normal. Sometimes making memories is more important than investing and this will level out in March, so we are all good moving forward.

I did hit the 25k milestone without the regular deposits, so that is really great news! Next up, 50k!

Capital Growth Portfolio

The Saxo portfolio is up 1.46%. Starting this month, I switched to a heavier stock allocation with this portfolio. I’m comfortable with the big market swings we have seen over the last two years, so I’m opting for a more offensive strategy, especially since I’m still at the beginning of my investing journey. This will be my fourth year!

Portfolio value: €6766.72

Deposits: €100

Growth/decline: €97.31

Retirement Fund Portfolio

The retirement fund was up 2.66% in February. As mentioned above, we see the stock-heavy (more offensive) approach is performing a lot better at the moment than bonds and other stuff.

Portfolio value: €3151.97

Deposits: €100

Growth/decline: €81.72

Index Fund & Stock Portfolio

Another month without any buys, without any deposits the portfolio was almost flat at a 0.08% decline

Portfolio value: €9280.19

Deposits: €0

Cash: -€2175.82

Passive income: €10.79

Real Growth/Decline: -€7.79

Ideal allocation (December 2022):

- Stocks: 75%

- ETFs & Cash: 25%

If you want to start investing, the platform I’m investing on is DeGiro, but you can also invest on other platforms like eToro.

Semmie Portfolio

No deposits this month, portfolio down 0.24%.

Portfolio value: €376.14

Deposits: €0

Growth/decline: -€0.91

P2P Lending Portfolio

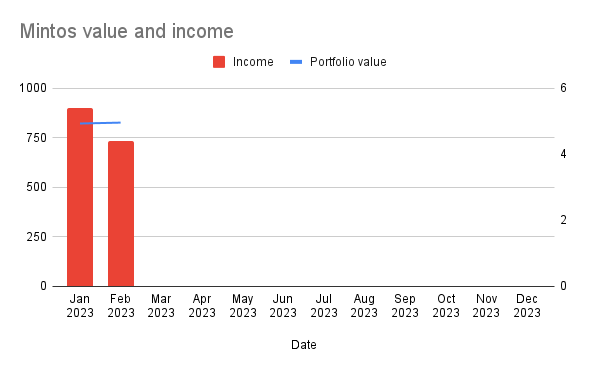

Mintos

Steady growth, as always, 0.56% this month. The passive income is always around €5.

Still paused any further deposits. Once I reach €1000 on this platform and €500 on EstateGuru, I will diversify platforms. The last 2 years have been nice on Mintos.

Portfolio value: €826.68

Deposits: €0

Passive income: €4.40

If you sign up using my affiliate link, we will both receive 1% of our average daily balance, which is paid in 3 instalments for the first 90 days.

EstateGuru

I’m currently invested in 5 projects on EstateGuru with a 9-11% interest rate.

Portfolio value: €396.11

Deposits: €0

Passive income: €7.37

If you sign up using my affiliate link, we will both receive a 0,5% bonus on all the investments done during the first 90 days of your registration on all the investments that move to funded status.

Corekees

Another month, another tree. It would be nice if there will be another project added with a shorter project duration.

Portfolio value: €112.5

Deposits: €22.50

Crypto Portfolio

February has been another nice month, portfolio is up 8.55%.

The rest of the assets are still growing slowly because of the interest. Swissborg is giving me a 4.5% yield on my bitcoin and 7.75% on my USDC.

I also want to remind everyone how important it is to keep most of your crypto off the exchanges you are trading on. I keep mine on a Ledger.

Portfolio value: €3965.23

Bitcoin value: 0.0653849 (+0.15%)

Ethereum value: 1.04744777 (+3.53%)

Deposits: €0

Withdrawals: €0

Growth/decline: €312.26

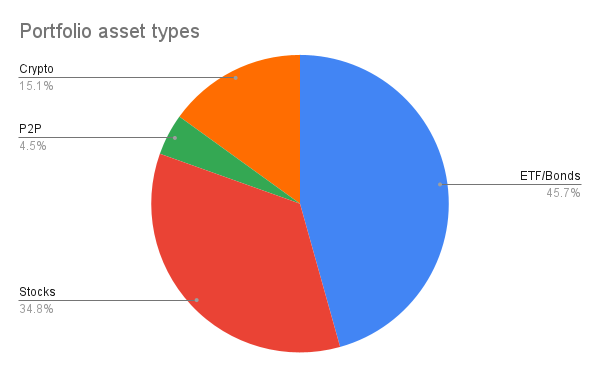

Total Portfolio Overview

Portfolio value: €25000.53

Deposits: €222.50

Withdrawals: €0

Passive income*: €22.56

Total growth/decline: €518.98

Asset growth/decline: €296.48

* This only includes P2P & Dividend

Ideal allocation (January 2022):

- ETF & Bonds: 45%

- Stocks: 25%

- Cash: 0-5%

- P2P-lending: 5%

- Crypto: 20%

Ideas for March

In the coming months, it is time to add some to the cash position and invest a little more in crypto if the crypto portfolio doesn’t turn around. This will be needed to keep the 20% allocation.

Website Goals

- Nothing new planned