The beginning of 2020 has been great, I became a dad for the second time. Just before 2020 started, so that was an awesome start of the year! My research in investing has been somewhat slacking because of it, but I can’t think of a better reason. That’s why it was an easy decision to follow my plan and add another €100 to Grupeer to even it out with Mintos. I also added another €100 to my index fund portfolio.

The P2P lending portfolio is generating some steam now, more loans are paying interest so the passive income is slowly rising.

So the second half of February has not been great for the investments, the COVID-19 virus has a lot of impact on the stock market. So my stock portfolios took a big dive in the last two weeks. Nothing really to be concerned about since it’s all long term strategies anyway.

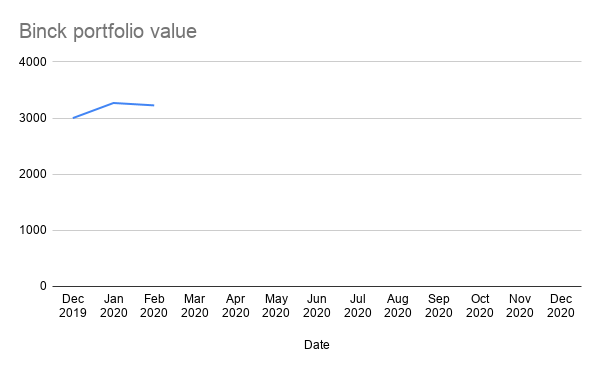

I changed my graphs a little, I think the portfolio value is better displayed as a line and the income is better shown as a bar.

Capital Growth Portfolio

So as I previously said the two last weeks of February caused my capital growth portfolio to end the month in a loss. Although I deposited €100, the total value decreased with -€42.57.

Portfolio value: €3226.73

Deposits: €100

Index Fund Portfolio

My ETF portfolio also performed quite badly and noted a -€24.57 decline. As I’m typing this we are seeing a small recovery, but since the Coronavirus impact is still developing it could drop further coming weeks.

Portfolio value: € 178.57

Deposits: €100

P2P Lending Portfolio

Mintos

So with my portfolio deposits at €500, I’m going to let it run for a while. It’s nice to see the passive income increasing and getting reinvested, so I’m really looking forward to seeing the compound interest in the graph.

Portfolio value: €512.28

Deposits: €0

Passive income: €5.03

If you sign up using my affiliate link, we will both receive 1% of our average daily balance which is paid in 3 instalments for the first 90 days.

Grupeer

In February I deposited another 100 euros to make the investment even to Mintos. For now, this will be enough it will put my P2P portfolio at 23%, which is fine for now. I will probably lower it a bit next month to 20%.

Portfolio value: €503.94

Deposits: €100

Passive income: €2.84

Total Portfolio Overview

Portfolio value: €4421.52

Deposits: €300

Passive income: €7.87

Total growth/decline: €144.99

Real growth/decline: -€155.01

Ideas for March

The strategy for this month will depend on the coming news about the COVID-19 outbreak in Europe and the US. I expect the development there to be of great importance to what the market is going to do. I guess the spread of the virus will determine if we are likely to see more red numbers. I will deposit €200 in the index fund portfolio, but I’m not sure I will be buying anything with that money just yet.

I think the market recovery will be quick as well as the decline, but I am going to wait until I see some signs of recovery before buying my ETF’s. I’m also going to research bond ETF’s because they tend to perform better in a market crisis. Central banks are likely to lower interest rates to improve economic recovery, which normally leads to an increase in the value of bonds.

Website Goals

- Brainstorm about additional content for the website