The markets have cooled down a little, some of the growth stocks I have are steadily dropping to previous resistance levels. I’m still in profit with them because I was really early in buying them. I did lose a little focus on the stock market because of it, and it made me doubt whether I should increase my ETF positions again.

The crypto market is still going crazy, so I’m putting more time into that. So far, it’s really nice to follow such a quick market, but it also means you can follow it for so long before it takes up too much time on a regular basis.

Lastly, I dug up some old Magic: The Gathering cards at the attic, and I’ve been selling them online as a side-hustle, so far made a couple of hundred bucks, which I naturally will be investing in the future.

Capital Growth Portfolio

Another good month for this portfolio with a 2.56% increase.

Portfolio value: €5183.80

Deposits: €100

Growth/decline: €226.98

Retirement Fund Portfolio

Steady growth in the pension fund, 4.12% monthly increase.

Portfolio value: €1132.1

Deposits: €100

Growth/decline: €140.80

Index Fund & Stock Portfolio

The growth stocks (BLDP, SPCE, CRM & OPEN) aren’t doing too great this year. BLDP was the worst stock investment so far. I practically jumped in on the top and didn’t use proper risk management, and cut my losses on time. I will probably just hold for now… The rest is still in the green. However, if I was a trader, I should have taken profit in the last couple of months.

The big investment in the dividend stocks is really showing some results this month! I got €23.31 of dividend income this month, which is the highest since starting this portfolio. On top of that, all of the dividend stocks are in the green!

I am still working on getting the cash position in the plus again. Meanwhile, I will keep reconsidering my strategy because it might be less time consuming to go more into ETF’s.

Portfolio value: €3863.45

Deposits: €200

Cash: -€1090.15

Passive income: €23.31

Real Growth/Decline: €-182.86

If you want to start investing as well, the platform I’m investing on (DeGiro), but you can also invest on other platforms like eToro.

Semmie Portfolio

No comments, just a little growth!

If you are living in the Netherlands and you are interested in using this platform, send me an e-mail on info@coinpooper.com. I will send you the affiliate link to enjoy a €15 signup bonus!

Portfolio value: €132.27

Deposits: €0

Growth/decline: €0.70

P2P Lending Portfolio

Mintos

No comments, just steady growth!

Portfolio value: €568.28

Deposits: €0

Passive income: €4.66

If you sign up using my affiliate link, we will both receive 1% of our average daily balance, which is paid in 3 instalments for the first 90 days.

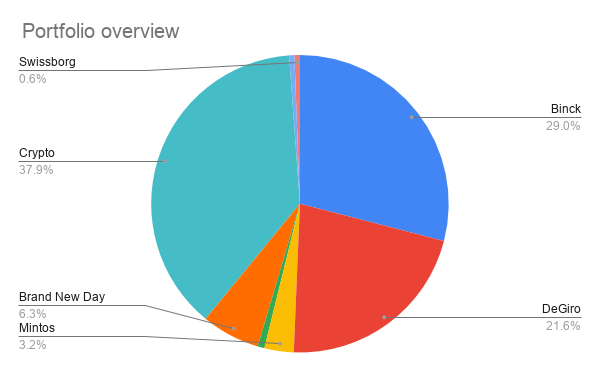

Crypto Portfolio

The portfolio growth rate is down a little, but still insane with ~10.75% total increase in portfolio value.

Swissborg also enabled their bitcoin yield wallet, and it gives me a 4.5% yield on my bitcoin. This is a little lower than BlockFi, which has 5.0%, but I like to spread my crypto over different platforms. This month I deposited another €50 on Swissborg and turned it into USDC. Celsius is still on my list to test. However, first I want to use these two platforms for a while.

The increase in my portfolio is mostly thanks to Ethereum pumping, which also changed the portfolio coin split, which is now 44% ETH, 28% BTC & 28% HTR.

I also want to remind everyone, especially now that crypto is quickly appreciating in value, how important it is to keep the bulk of your crypto off the exchanges you are trading on. I keep mine on a Ledger.

Portfolio value: €6877.09

Bitcoin value: 0.04315629

Ethereum value: 1.07729653

Deposits: €50

Growth/decline: €667.66

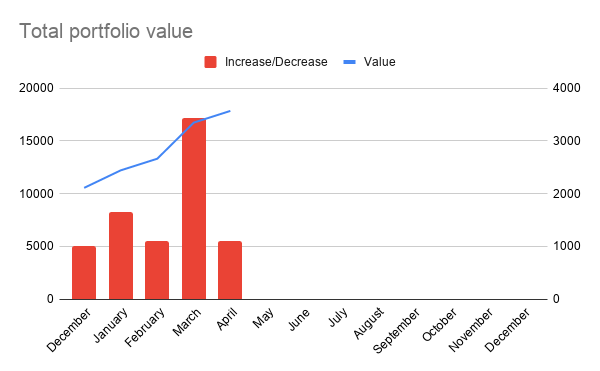

Total Portfolio Overview

Portfolio value: €17858.02

Deposits: €450

Passive income*: €27.97

Total growth/decline: €1108.61

Real growth/decline: €658.61

* this only includes P2P & Dividend

Ideas for May

I will keep following the crypto markets closely and might start scaling out a little to get more balance in my portfolio.

Website Goals

- Nothing new planned